What is the Most Important Insurance in Florida?

Insurance helps to protect against unexpected financial losses. When you and your loved ones are protected, you will enjoy peace of mind and live your best life without worries and fear. To get the best Insurance policy and premiums in Florida, you must clearly understand the following:

Your current financial situation and your needs

The available insurance products on your local market that can provide the coverage you seek

All inclusions, exclusions, and possible options (riders) of the policy

The costs of your coverage and how to save on your policy

How to work with a Florida-licensed insurance agent or a broker who represents multiple insurers and has an extensive portfolio of options to choose from.

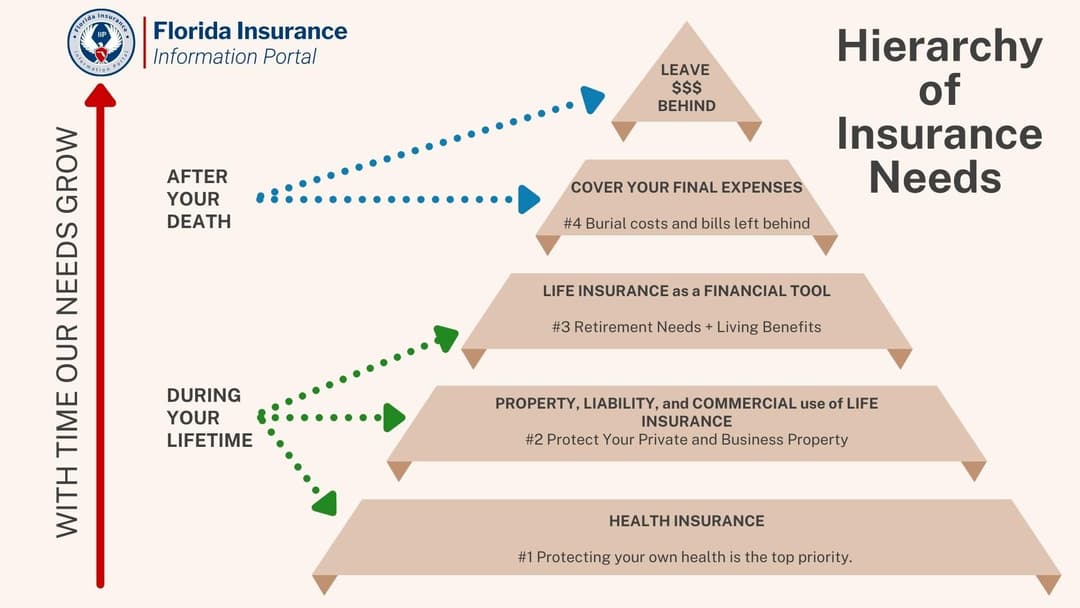

According to the Hierarchy of Insurance Needs, Health Insurance is the most important insurance for everyone.

The Most Important Insurance in Florida:

HEALTH INSURANCE

The most common leading causes of death in Florida are heart disease, cancer, accidents, stroke, Alzheimer’s disease, diabetes, suicide, and kidney disease. These conditions can make people incur high medical bills that can force them into debts. It is advisable to get Health Insurance that can cover such conditions. Health Insurance is a type of insurance that covers medical bills that arise due to an illness, injury, or disability. Two medical coverages are common with Health Insurance in Florida:

Basic medical coverage: This includes coverage for hospital stays, and surgical and medical costs associated with treatment.

Major medical coverage: This is typically issued under a managed care system like Exclusive Provider Organizations (EPOs), Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point-of-Service Plans or under a traditional system. Major medical coverage includes hospitalization, preventative care, emergency services, and management of chronic conditions.

Why Do you Need Health Insurance?

The most important type of insurance is Health Insurance, and approximately 4 million Floridian adults do not have it. That is equal to over 19% of the population. There are a lot of health issues and unhealthy lifestyles common among Florida’s adults:

Poor health (19-20% of adults)

Adult obesity (over 27%, that is nearly 6 million adults)

Adults with diabetes (nearly 11%)

Smokers (nearly 15%)

Florida's uninsured population does not have access to health coverage. Hence, they would have to pay for medical bills out of their pockets. Having Health insurance is very important to protect you and your family from financial hardship associated with medical expenses. In addition, you and your family can also take advantage of preventive care and intervention services provided by some Health insurance policies in Florida to achieve and maintain good health. Generally, having Health insurance gives you peace of mind whenever anything happens to you or any member of your family that requires enormous medical bills.

In Florida, you Need Health Insurance When:

You want to provide safety and health security for yourself and your loved ones. Therefore, Health insurance should be the first insurance policy anyone and everyone should get to protect themselves and their loved ones. Health insurance is vital for all Floridians, including persons with no underlying health conditions and persons with common illnesses in Florida like heart diseases, cancers, strokes, Alzheimer’s, diabetes, and kidney disease. Typical health insurance covers doctor and hospital visits, wellness care, prescription drugs, and medical devices. However, it excludes cosmetic surgeries, beauty treatments, infertility/pregnancy-related conditions, off-label drug use, or diseases related to overconsumption of alcohol.

Discuss with a Florida-licensed Health insurance agent who can help determine your Health insurance eligibility and design a plan that suits your health needs.

Going along the Hierarchy of Insurance Needs, the 2nd most important type of insurance in Florida is Property and Liability. This insurance group is for homeowners, renters, and business owners alike:

The 2nd Most-Important Insurance

PROPERTY and LIABILITY Insurance: Personal and Business

Property and Liability insurance typically protects buildings you own, business property inside and outside of buildings, and inventory against loss or damages. It also includes liability coverage that protects you against claims due to property damage or accidental injuries sustained on your personal or business property. Some common perils that Property and Liability insurance covers in Florida are:

Theft: In 2018, a total of 485,270 property crime cases were reported in Florida.

Lightning: Approximately 1.2 million cloud-to-ground lightning strikes are reported in Florida yearly.

Vandalism: The rate of vandalism in Florida is about 3.70 per 1,000 residents each year.

AUTO INSURANCE

Auto insurance is a type of insurance that provides coverage for motorized land vehicles like pickups, passenger-type automobiles, trucks, vans, and motorcycles. Florida drivers are required to carry a minimum of $10,000 in Personal Injury Protection (PIP) and a minimum of $10,000 in Property Damage Liability (PDL). A typical Auto insurance in Florida provides the following coverages:

Property: Damages to your vehicle (including yours and that of others) or theft of your vehicle

Liability: Bodily injuries and property damage caused by an accident

Medical: Medical, hospital, and surgical bills and/or funeral expenses associated with injuries sustained in an accident

In Florida, vehicles used for private purposes (excluding livery vehicles and those rented to others) are expected to have the following types of Auto insurance:

Private passenger auto no-fault: It is also known as Personal Injury Protection (PIP) in Florida. It pays for medical expenses and loss of income regardless of who’s at fault

Private passenger auto liability: This covers bodily injury or property damage and other coverages not involving damage to the vehicle itself

Private passenger auto physical damage: It covers comprehensive, collision, and other coverages involving damage to the vehicle itself

The following types of Auto insurance are applicable for vehicles used for commercial purposes:

Commercial automobile liability: It covers liability claims due to bodily injury or property damage, medical payments, and other coverages not involving damage to the vehicle itself

Commercial auto physical damage: It pays for the repairs or replacement of your vehicle if it is stolen or damaged. It includes:

Collision coverage: Pays for physical and mechanical damage when you hit other people’s cars, or the cars of others hit yours, or your vehicle is overturned. It also covers repairs or replacements when your car hits objects like trees or fences.

Comprehensive coverage: Pays for any losses to your insured vehicle(s) that collision coverage does not cover.

Provide other coverages that include damage to the vehicle itself.

Why is Auto Insurance Important in Florida?

As of 2022, there were approximately 18,081,511 private and commercial vehicles in Florida. About 80% (about 10,325,833) of adult residents drive alone to work, and over 42% of Florida drivers engage in long commutes. Nearly a fifth of Florida vehicles (more than 3.6 million) are uninsured or underinsured, which implies that there is either no coverage or insufficient coverage in the event of property damage, bodily damage, or death caused by those vehicles. Approximately 2,573 crash deaths occur in the state yearly, and about 106,491 crashes have been recorded between January and April of 2022. Therefore, Florida law makes it mandatory for drivers to carry proof of up-to-date insurance whenever they drive. Driving without Auto insurance in Florida can lead to driver's license suspensions. Hence, it is important to have Auto insurance in Florida because:

It is mandatory according to Florida law

It compensates others for accidents caused by you

It compensates you for accidents caused by others

It helps to repair your car irrespective of who caused the accident

It protects your assets

It helps to protect your passengers

It brings peace of mind to everyone

It protects your auto lender

In Florida, you Need Car Insurance if:

You own a car: Auto insurance protects you against financial loss due to an accident or theft.

You allow others to use your car: It provides coverage for damage to another person’s vehicle caused by someone else using your vehicle. However, the person driving your vehicle at the time of the incident must be listed on your auto insurance policy.

You intend to pay the mortgage on your car: Your lenders will require you to have Auto insurance coverage to protect their investment.

You want peace of mind: It costs a lot to own a car and maintain it. Hence, having Auto Insurance gives you peace of mind if anything unexpected happens to your car. You do not need to be bothered about how to pay out of your pocket for any damages sustained by your car or that of others because you have Auto insurance.

RESIDENTIAL INSURANCE

In 2022, there were about 21,993,914 properties in Florida, with 10,071,374 housing units on the rental market. Out of these housing units, over 65% (6,585,671) are owner-occupied and 35% (3,485,702) are for rent. Miami Dade County has the most rental units, offering almost 49% of its housing for rent, and around 51% as owner-occupied, while Sumter County is almost 90% owner-occupied.

Over 10 million housing units in Florida need insurance coverage. At a minimum, all owners of these properties should have Homeowners, Condo insurance, and/or Business property insurance (for apartment complexes) to protect their financial investments from possible loss or damage. The median household income in Florida is around $59,200, and individuals should ensure some percentage of this income goes to insurance.

Residential insurance typically provides coverage against damage to a building an insured resides in, whether owner-occupied or rented. The insured dwelling may be built, manufactured, or mobile. Some common types of Residential insurance you will find in Florida are:

Homeowners insurance,

Renters insurance,

Condo insurance, and

Landlord Insurance.

Although most Residential Insurance doesn’t cover damage caused by earthquakes and flooding, individuals who desire Earthquake and Flood Insurance should consider purchasing Disaster insurance. Individuals can also add Disaster insurance to their Residential insurance policies to have a more comprehensive coverage.

HOMEOWNERS INSURANCE

Homeowners insurance is a type of property insurance in Florida that protects an insured’s property against loss by theft and damage caused by perils like fire and storm damage. This type of insurance can also cover accidental injuries or death within the insured’s building for which the insured may be responsible. Homeowners insurance policy in Florida typically comes in five types:

HO-1 (basic form): This type of Homeowners insurance policy provides coverage for damages caused by perils like explosions, lightning, fire or smoke, theft, hail and windstorms, volcanic eruption, vandalism, damage from vehicles, aircraft, riots, and commotion.

HO-2 (broad form): This type of Homeowners insurance policy covers home structures and personal belongings. Some even protect against personal liabilities. HO-2 covers the same perils named in HO-1 plus the following:

Accidental discharge or overflow of water or steam

Falling items

Freezing of household systems like plumbing or HVAC systems

Sudden and unexpected damage from an artificially generated electrical current

Sudden and unexpected tearing apart, burning, cracking, or bulging of household systems

Weight of ice, snow, or sleet

HO-3 (special form): Unlike HO-1 and HO-2 policies, which are named-peril policies (only covers perils named in the policy), HO-3 is an open-peril policy (covers any kind of peril, excluding floods and earthquakes). A typical HO-3 covers the home, structures attached to the home, the insured’s belongings, and liabilities resulting from injuries sustained on the insured’s property.

HO-5 (comprehensive form): This kind of Homeowners insurance policy offers open peril coverage for personal belongings and the building structure itself. It typically pays the replacement cost of the covered item and has a higher coverage limit for valuables like jewelry. HO-5 is more expensive than many others, and not many houses in Florida are eligible for this type of coverage.

HO-8 (older home form): This protects homes that are 40 years old or above. A typical H0-8 policy provides similar coverage as HO-1 and covers the dwelling, liability, personal property, and loss of use from named perils in the insured’s policy.

In Florida, you Need Homeowners Insurance if:

You own a home: Your home is a valuable asset that you should protect by all means. Having a Homeowners insurance policy protects your house, attached structures, personal belongings, and liability coverage for accidental injuries sustained by third parties on your property.

It is bank-required: Individuals with mortgages must have Homeowners insurance because lenders want to secure their investments against damage by covered perils. A lender can even purchase Homeowners insurance for a borrower who does not have the required policy and charge the borrowing homeowner for the cost (this can be more expensive and have limited coverage).

RENTERS INSURANCE

Renters insurance is commonly known as HO-4 (or Tenant-Homeowners) policy in Florida. It provides coverage for tenants' items and permanent fixtures installed in their rented dwellings. Tenants buy Renters insurance coverage to protect their belongings from possible damages or loss. Average renters’ insurance is inexpensive and usually covers the tenant's property from theft and damages caused by fire, smoke, water, and vandalism. Some landlords in Florida may require Renters insurance as a leasing condition. A typical Renter insurance in Florida includes coverage for:

Personal property loss due to a covered peril

Personal liability due to accidental injuries sustained by third-parties

Additional living expenses resulting from loss of use

You Need Renters Insurance if:

You are a tenant: Individuals who live in rented dwellings or college students who live in dorms should consider getting Renter insurance. It helps to protect against financial loss due to personal liabilities and belongings lost to covered perils. It also pays expenses if a disaster displaces tenants from their homes.

Your Landlord requires it: Most landlords in Florida require tenants to carry Renters insurance to alleviate their liability for personal property losses and any accidental injuries sustained by third parties in the tenant’s home.

CONDO INSURANCE

Common areas like land, hallways, and other shared areas of condominiums are mostly covered by the collective homeowner’s association insurance policy. However, it excludes each condominium unit and everything in it. Condo insurance is commonly referred to as HO-6 policy and “walls-in” coverage in Florida because it provides coverage for the interior of condominiums. In addition, Condo insurance provides coverage for:

Building properties

Personal properties such as clothing, furniture, electronics, or jewelry in your Condo

Personal liability, including legal expenses or medical bills from claims that may arise due to accidentally harming others or damaging their property

Additional living expenses incurred when the Condo becomes uninhabitable by a covered cause of loss

You Need Condo Insurance if:

Own a Condo: This ensures you are covered when damages or liabilities occur in your condo.

You intend to pay the mortgage on your condo: Lenders will require condo owners to purchase Condo insurance to protect their investment.

LANDLORD INSURANCE

With nearly 3.5 million housing units in Florida as rentals, landlords need Landlord insurance, which covers the property itself from the possible liability claims arising from the tenants and their guests. As a landlord, you will need protection from financial loss resulting from theft, fire outbreak, or severe weather that damages your rental properties.

Landlord insurance provides coverage for:

The dwelling

Personal property

Accidents and injuries that occur on the premises of your rented home

You Need Landlord Insurance if:

You are financing a rental property because most lenders will require it

You own a property that you have rented to tenants

COMMERCIAL INSURANCE

Businesses are being formed - more and more every year. Over a million new Florida businesses got registered during the COVID pandemic years of 2020-2021. In 2022, there were around 2.5 million small businesses in Florida, employing around a quarter of adult residents. Florida's Gross Domestic Product (GDP) comes 4th after California, Texas, and New York. Hence, it is important to purchase a Commercial Insurance policy in Florida to protect your business against financial losses arising from covered perils.

Commercial insurance (also known as business insurance) protects Florida businesses against financial loss due to client lawsuits, customer or employee injuries, property damage, business interruption, and business-related crimes. Commercial Insurance typically provides two main coverages:

Commercial property coverage: Covers damages done to your business property

Liability coverage: Cover the cost of liability claims brought against your business due to accidental injuries sustained on your business premises

Reasons you need Commercial insurance in Florida include:

It protects your business from damages

It protects and provides benefits to your employees

It protects your customers

It helps to recruit and retain workers

It builds business credibility

It offers peace of mind

It protects against natural disasters

Most business operations and contracts require it

You Need Business Insurance if:

You own or rent office space: It is good to insure your business property to reduce business risks, and if you are a business tenant, your landlord may require it. Lenders will also require Commercial Insurance from business owners who want to get mortgages for their businesses.

You own commercial property: Businesses with valuable properties on their business premises should consider getting Commercial Insurance to protect their expensive equipment and inventory.

You have employees: Commercial Insurance may provide coverage for business-related crimes perpetrated by employees and work-related injuries sustained by them.

Note: Commercial (group) health insurance is purchased through health insurance agents and/or brokers (not commercial insurance agents).

DISASTER INSURANCE

Florida is prone to many natural disasters like floods, storms, hurricanes, tropical depressions, tornadoes, and wildfires. For instance:

Flooding is the most common hazard in Florida, with about 2,252,244 properties that have a 26% chance of being affected by severe flooding over the next three decades. Asides from property damage, access to transportation, utility, emergency services, and overall economic well-being can be affected by flooding. About 25% of flooding is currently expanding past the earlier designated flood zones, and you need to protect yourself, your loved ones, and your business.

As of 2022, over 3,500 tornadoes were recorded in Florida, causing over $1.7 billion in property damage.

Homes are exposed to risk of flooding based on the strength of the storm, the surge it creates, and the distance of the home from the coastline. The farther inland you are, the stronger is the required surge, to cause damage.

| Storm Surge (Category Level) | Exposure of single-story Florida homes to surge (in 2020) |

| Category 1 Hurricane | 353,994 |

| Category 2 Hurricane | 1,088,511 |

| Category 3 Hurricane | 1,806,312 |

| Category 4 Hurricane | 2,362,323 |

| Category 5 Hurricane | 2,851,642 |

- 2,262 wildfires were recorded in Florida in 2021.

Disaster Insurance protects residences and businesses against natural disasters (like floods, earthquakes, and hurricanes) and man-made disasters (like riots or terrorist attacks). Most Disaster Insurance policies cannot be bought separately because they usually come as add-ons to existing standard property insurance policies.

You Need Disaster Insurance if:

You reside in high-risk areas: Get a Disaster Insurance policy to protect you and your properties if you live in areas prone to natural disasters like Lee, Miami-Dade and Monroe counties.

You have Homeowners insurance: Most Homeowners Insurance policies do not cover damage and destruction resulting from earthquakes, floods, tsunamis, or extreme storms.

Your commercial property insurance excludes damages caused by natural disasters like floods and earthquakes.

Your lender requires it.

Your business is located in a high-risk area.

3rd Most-Important Insurance - Life Insurance:

According to the Hierarchy of Insurance Needs, the next most important type of insurance every adult in Florida should have is life insurance.

Life insurance can be divided into two main usage types:

Living benefits:This is when insureds are permitted to spend out of their death benefits while still alive.

Death benefits: This refers to the payout given to policy beneficiaries at the insured’s demise. However, some insurers may allow the death benefit to be used before the insured’s death to pay for medical treatments when the insured is terminally ill.

After the insured’s demise, Life Insurance is further divided into two sub-groups:

Basic Life Insurance: provides coverage for end-of-life expenses like medical bills, burial, or cremation.

Financial Security (or Legacy) Life Insurance: this is the death benefit paid out to the policy beneficiary after paying the insured’s final expenses.

LIFE INSURANCE

Death is inevitable, and the fact is that when we die, someone must pay for the funeral and other final expenses we leave behind. In 2022, nearly 47% of Americans did not have any life insurance coverage, which leaves their relatives and friends in limbo when they die. Those left behind frequently must find ways to pay for the funeral costs, not knowing where the money for these costs will come from.

In 2019, almost 207 thousand Florida residents died. Nearly 157 thousand (76% of the total) were seniors (65 years and older). Compared to eight years prior, in 2011, when around 173 thousand Florida residents died - with nearly 130,000 (75% of the total) seniors. The growth in deaths is mostly due to the steadily increasing number of residents and the aging of a large group of population. (In 2020 total deaths spiked to nearly 240,000, mostly due to poor handling of COVID crisis by the state authorities).

Life insurance provides a death benefit to policy beneficiaries at the insured’s demise. This death benefit can be used to pay off debts, college tuition fees, daily expenses, and funeral arrangements. There are two types of ife insurance in Florida:

TERM LIFE INSURANCE

CASH VALUE (Permanent) LIFE INSURANCE

Term Life Insurance offers coverage for a specific period and is usually cheaper. It is meant only to pass-on a predetermined amount of money (death benefit) to the beneficiaries after the insured’s death, making sure that the final expenses and funeral are paid for and the beneficiary’s needs are covered.

Permanent Life insurance provides lifelong coverage, as long as the premium is paid. In addition to the death benefit, the insured gains ways of saving up cash values, which can be accessed while they are still alive, referred to as the Living Benefits. Cash Value (Permanent) insurance is a life insurance policy PLUS other possibilities which are generally not available on Term life insurance, like:

Ability to use the death benefit while you are still alive, where this loan to yourself is eventually repaid from the death benefit, before the remaining sum is paid out to your beneficiaries,

Tax-deferred compounded growth of interest which can be accessed as tax-free loans to yourself, to assist during the retirement years, without affecting the social security eligibility,

Zero-Loss Guarantee on stock market backed cash value investments, in case the market takes a downturn. (see IUL)

Ability to pre-pay the policy in a certain amount of time and maintain coverage for free for the rest of your life. The cash value invested in the stock market index during the prepayment period typically grows high enough to sustain the account premiums and keep the policy alive, without any further out-of-pocket costs for the insured.

Ability to finance the premium, where the insured does not have any out-of-pocket costs. The premium financing loan is guaranteed by the insured’s assets and the generated cash value covers the ongoing cost of coverage.

Major reasons to purchase life insurance in Florida:

Financial security for loved ones

Tax-free retirement income

A cash value component that insureds can withdraw from, borrow against, or use to pay premiums while still alive

Replace lost income

Debt repayment

Cover funeral and burial expenses

Pay for education expenses

Financial investment

Fund business or partnership buyouts in the event of one of the business owners’ demise

With 46% of Americans dying with savings of less than $10,000, over 2.2 million Florida seniors could be placing unnecessary and frequently unbearable financial burdens on their families and friends. Instead of grieving their loss, the family will be left with no choice but to concentrate on finding a way to cover the incurred financial burdens.

You Need Life Insurance if:

You have dependents: Consider getting Life insurance to prevent your loved ones from suffering adverse financial effects due to your demise. Life insurance coverage will help cover household expenses like mortgage and food bills, college tuition fees, and funeral costs.

You are an older adult without savings: Although it is best to get a Life insurance policy at a young age to enjoy reduced premiums, having it at an older age is also very beneficial. Older adults without savings should get Life insurance policies like Funeral Expense to cover funeral and burial expenses at their demise. This policy is usually less expensive.

You own a business: Business owners should get Life insurance to keep their business afloat if they or a key person dies. The policy beneficiary is the company. Therefore, if anything happens to the business owner, employees can use the payout to pay creditors, recruit new top executives, or even manage severance payments if staying in business isn’t possible. Life insurance can also be used as part of a buy and sell agreement where business partners can use payouts to purchase the deceased owner’s share of the business.

You want living benefits: Here, you can get funds from your Life insurance policy while still alive.

Basic Life Insurance to Cover Final Expenses and Burial

Why Do I Need Basic Life Insurance Policy for Final Expenses?

Approximately 4,605,422 of Florida residents (nearly 21% of the state's population) are 65 years or older. Having a basic Life insurance policy for final expenses will cover final medical bills, burial expenses, and other end-of-life expenses at your demise.

You Need Basic Life Insurance When:

You want to protect your loved ones from the financial implications of your burial costs and other end-of-life expenses. Basic life insurance helps your loved ones prepare for your demise. It also helps to pay debts you may have incurred, reducing the financial stress on your family when you die. Most adults with severe health conditions that might not qualify for other types of life insurance policies prefer to go for Term or Final Expense insurance to cover their final needs.

Cost of End of Life Expenses in Florida

Average Cost of Funeral in Florida

Coming up with funds to bury someone can be difficult for many families. Hence, not planning for your death ahead of time can make life stressful for your loved ones. The average cost of a funeral in Florida is between $6,500 and $10,700. This price can vary depending on the materials and details of the funeral. For instance, a casket made out of wood is cheaper than those made out of other materials, and some burial locations within the cemetery cost higher than others. It is good to put measures in place before your demise. This will help your loved ones handle the cost of your funeral. Get the following Life insurance policies can help cover your funeral, memorial service, headstone, urn, and other final expenses:

Term Life insurance

Final Expense insurance

These Life insurances have death benefits and are less expensive compared to other Life insurance policies. However, suppose you want to leave substantial money behind (beyond catering for funeral expenses) or build cash values to fund a tax-free retirement. In that case, you should speak with a Florida-licensed Life insurance agent to discuss the possible options and costs to see what Life insurance type suits your needs.

Most Common Types of Life Insurance in Florida are:

Term Life

Final Expense (FE), and

Indexed Universal Life (IUL)

Term Life Insurance: This is an affordable Life insurance policy with an expiry date, usually 5 to 30 years. Death benefits are only paid if the insured dies during the policy term. The proceeds from the death benefit can be used to pay for funeral arrangements and day-to-day bills such as mortgage and child care. When the Term Life policy is about to expire, the insured can convert the policy to a permanent coverage like Whole Life insurance. The insured can renew it for another term, surrender it, or terminate it. However, if the insured outlives the coverage, the policy will expire, and the policy beneficiaries will not receive any death benefit. Term Life insurance premiums are calculated based on age, gender, health history, occupation, and tobacco use. When choosing Term Life insurance, you can choose between:

Level term: This is a type of term life insurance where the premiums and death benefit amount remains the same throughout the policy term, regardless of when the insured passes away.

Decreasing term: This is a type of term life insurance in which the death benefit amount decreases monthly or annually until the end of the term.

Final Expense (FE) Insurance: This is a type of permanent Life insurance designed to ease the burden of end-of-life expenses on policy beneficiaries by covering funeral costs and other final expenses after the insured’s demise. Final Expense insurance does not expire, and no medical exam is required. Premiums are calculated based on age, gender, and overall health. FE typically comes in two types:

Guaranteed issue: this type of Final Expense insurance is best for older adults whose age or health prevents them from buying other Life insurance coverage. This policy does not require medical exams, and policy application approval is near-guaranteed regardless of health status.

Simplified issue: this type of Final Expense insurance is best for people in relatively good health who may not be eligible for traditional Life insurance coverage but want a policy that can cover end-of-life costs. Insureds are not required to take medical exams but might have to provide answers to a few health questions.

Indexed Universal Life (IUL) Insurance: this type of permanent life insurance provides financial security for policy beneficiaries at an insured's demise and a cash value tied to a market index that grows tax-deferred.

The best time to buy IUL is at a young age because it allows you to grow your cash value and have a higher death benefit and lower cost. The death benefits obtained from the IUL policy can be used to cover the insured’s medical expenses prior to death, funeral expenses, paying off debts, daily needs, paying college tuition fees, tax-free retirement income, etc. The cash value feature that comes with IUL can be used to:

Earn interest that you can withdraw or borrow against in case of an emergency

Self-fund policy premiums to maintain the life insurance coverage

Supplement retirement income without affecting social security benefits

Life insurance is not only limited to death benefits that are paid out after the demise of the insured. There is also an option of living benefit that enables the insured to spend out of their death benefits while still alive. The amount paid out to the insured would be deducted from the final death benefit that the policy beneficiaries will receive after the insured's demise. Living benefits are very common with IUL policies, and the money paid out is aimed to cushion the impact of old age and the accompanying long-term care. Common living benefit riders are:

Critical care illness rider

Long-term care rider

Terminal illness rider

Accelerated death benefit (ADB)

Accidental death rider

Tax-free retirement income

Family income rider